Best Broker For Forex Trading Fundamentals Explained

Table of ContentsThe Best Broker For Forex Trading IdeasThe Definitive Guide for Best Broker For Forex TradingThe Basic Principles Of Best Broker For Forex Trading Best Broker For Forex Trading - TruthsThe smart Trick of Best Broker For Forex Trading That Nobody is Discussing

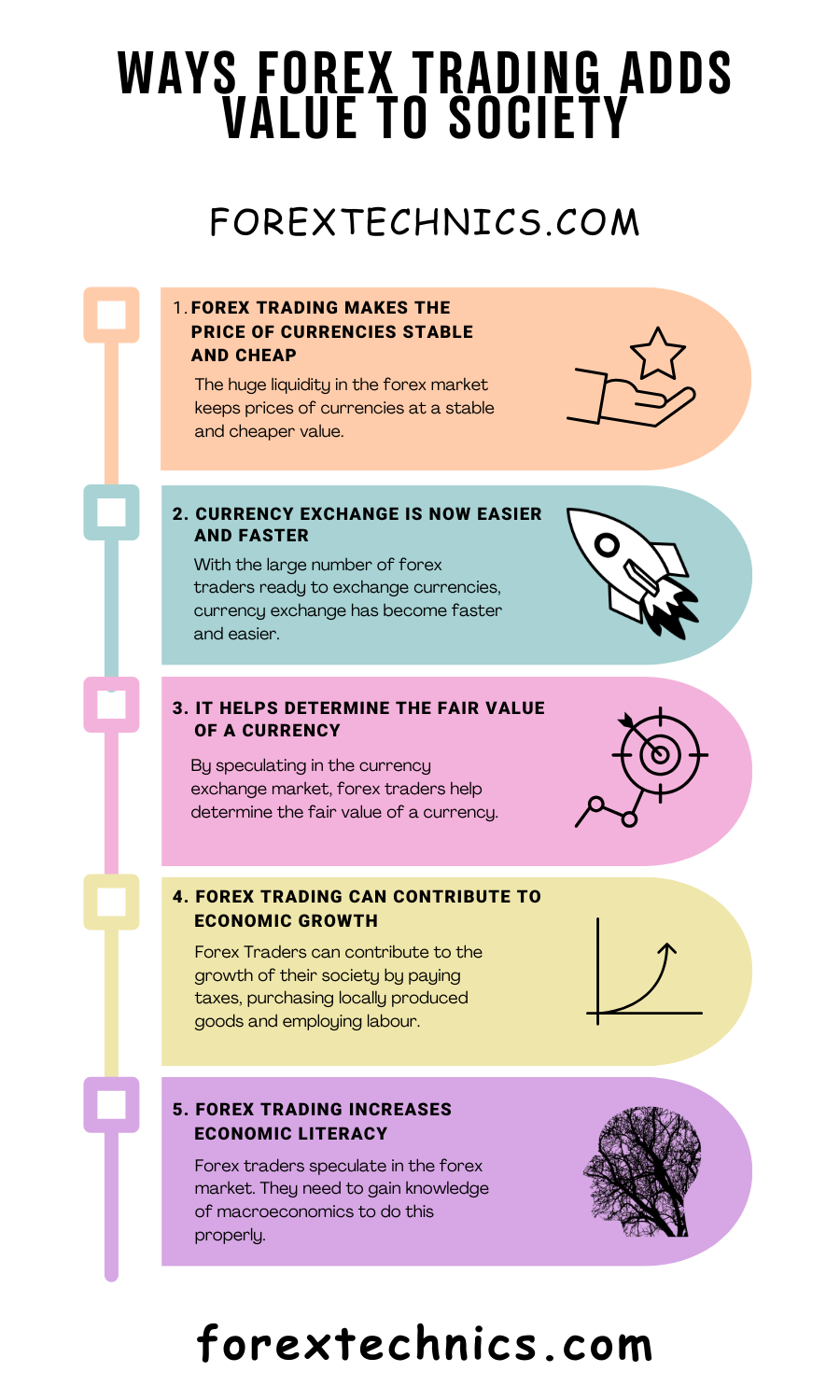

Because Forex markets have such a large spread and are used by a massive variety of participants, they offer high liquidity in comparison with various other markets. The Forex trading market is regularly operating, and thanks to modern-day innovation, comes from anywhere. Therefore, liquidity describes the truth that anyone can acquire or offer with a simple click of a switch.As a result, there is constantly a potential seller waiting to buy or sell making Foreign exchange a liquid market. Rate volatility is just one of the most crucial elements that aid pick the next trading action. For short-term Forex traders, cost volatility is critical, because it portrays the hourly changes in an asset's value.

For long-lasting financiers when they trade Forex, the rate volatility of the market is likewise fundamental. This is why they take into consideration a "get and hold" technique might supply higher incomes after a long period. One more substantial benefit of Foreign exchange is hedging that can be related to your trading account. This is a reliable approach that assists either get rid of or lower their danger of losses.

6 Easy Facts About Best Broker For Forex Trading Explained

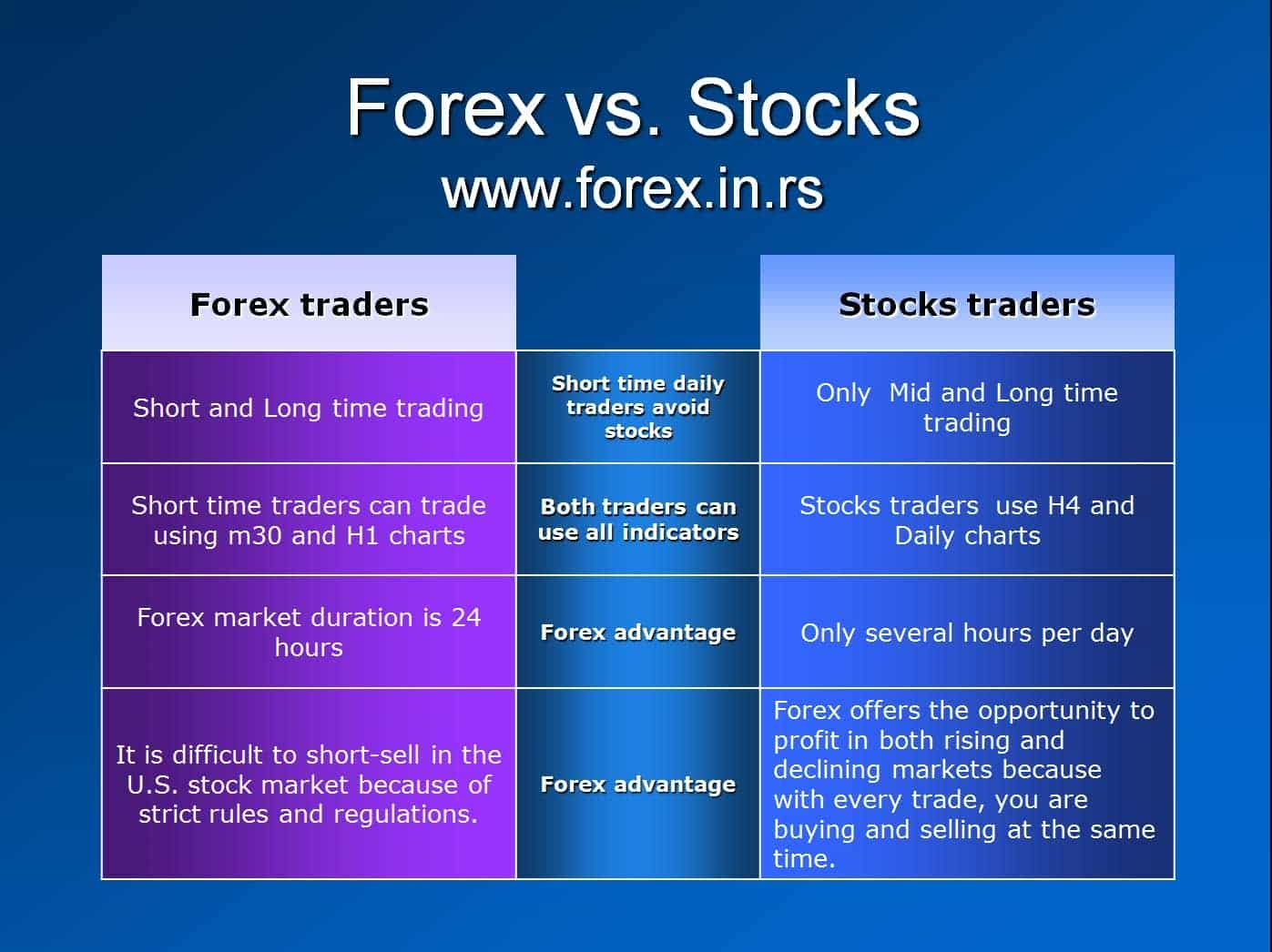

Relying on the time and effort, investors can be separated into categories according to their trading style. Some of them are the following: Foreign exchange trading can be successfully used in any one of the approaches over. Additionally, because of the Foreign exchange market's terrific quantity and its high liquidity, it's possible to go into or leave the marketplace any type of time.

Forex trading is a decentralized technology that operates with no central management. A foreign Forex broker should abide with the standards that are specified by the Foreign exchange regulatory authority.

Hence, all the purchases can be made from anywhere, and given that it is open 24 hr a day, it can also be done any time of the day. As an example, if an investor lies in Europe, he can trade during North America hours and check the relocations of the one currency he has an interest in (Best Broker For Forex Trading).

More About Best Broker For Forex Trading

A lot of Foreign exchange brokers can provide a really reduced spread and reduce or even remove the trader's costs. Capitalists that pick the Forex market can enhance their revenue by preventing costs from exchanges, deposits, and various other trading tasks which have additional retail transaction prices in the stock market.

It see it here provides the alternative to go into the market with a small budget and trade with high-value money. Some investors may not fulfill the needs of high leverage at the end of the deal.

Forex trading might have trading terms to shield the market participants, yet there is the threat that somebody may not value the concurred agreement. The Foreign exchange market functions 24 hr without quiting. Investors can not keep an eye on the changes daily, so they make use of formulas to protect their passions and their investments. Hence, my link they need to be constantly educated on how the innovation functions, or else they may face wonderful losses during the night or on weekend breaks.

When retail investors refer to cost volatility in Foreign exchange, they imply exactly how big the growths and drop-offs of a money set are for a specific duration. The bigger those ups and downs are, the greater the price volatility - Best Broker For Forex Trading. Those large changes can evoke a sense of uncertainty, and occasionally traders consider them as a possibility for high earnings.

Getting The Best Broker For Forex Trading To Work

Some of the most unpredictable currency pairs are considered to be the following: The Foreign exchange market uses a great deal of advantages to any Foreign exchange trader. As soon as having chosen to trade on fx, both knowledgeable and newbies need to specify their economic approach and get aware of the conditions.

The web content of this post mirrors the writer's viewpoint and does not always show the main placement of LiteFinance broker. The material released on this page is offered informative functions just and ought to not be taken into consideration as the provision of financial investment advice for the objectives of Directive 2014/65/EU. According to copyright have a peek here law, this post is considered intellectual property, that includes a prohibition on copying and distributing it without permission.

If your firm does company internationally, it is necessary to understand exactly how the worth of the U.S. dollar, relative to various other money, can considerably impact the rate of items for united state importers and merchants.

All About Best Broker For Forex Trading

In the very early 19th century, currency exchange was a significant part of the procedures of Alex. Brown & Sons, the first financial investment financial institution in the United States. The Bretton Woods Arrangement in 1944 required money to be pegged to the US buck, which was in turn pegged to the rate of gold.